- #TURBOTAX 1040X EFILE 2020 UPDATE#

- #TURBOTAX 1040X EFILE 2020 FULL#

- #TURBOTAX 1040X EFILE 2020 SOFTWARE#

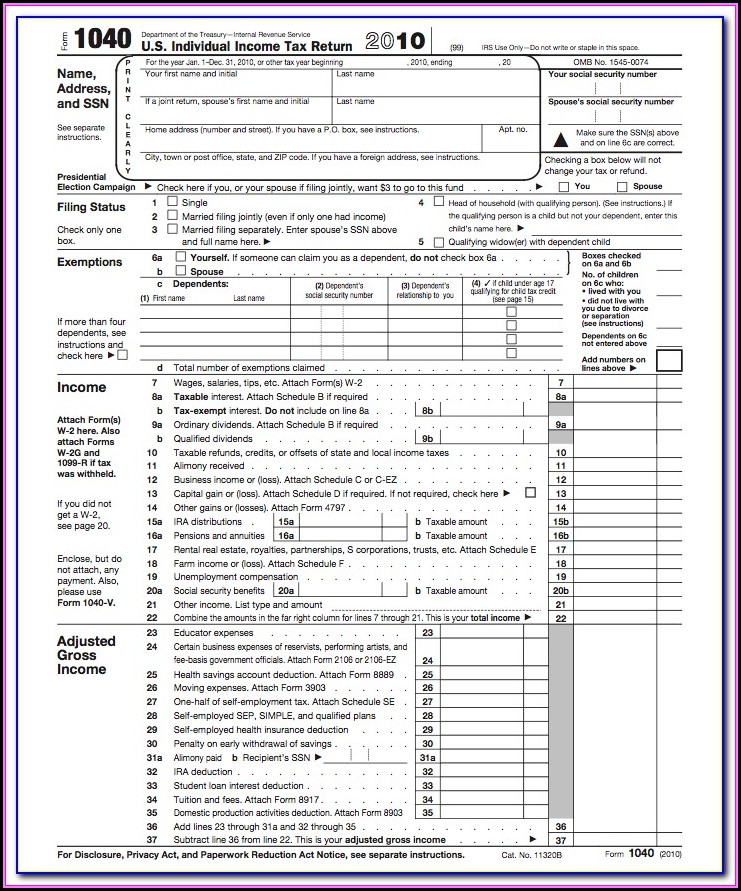

If the year isnt provided, write it in next to 'Other year.' Then, fill out your name, address, and Social Security number. At the very top of Form 1040-X, check the box next to the year of the tax return youre amending. The IRS will take up to 16 weeks or longer to process an amended tax return.īefore starting to amend the tax return, wait for the tax refund to be received or the taxes due to be paid and processed by the IRS. Fill in your personal information on Form 1040-X. When can I prepare and file the 1040X with Turbo Tax? Patricia H ()Īn amended return, Form 1040X, can only be printed and mailed to the IRS if the original tax return was not e-filed. I assume when I am able to correct the problem with the 1040, that the change will come thru to the Fed AGI on the AZ return and correct the AZ return. Many states also use the X suffix for the form number. No one can get you your tax refund faster than TurboTax with e-file and direct deposit. Like the IRS, states typically use a special form for an amended return. Login to your TurboTax account to start, continue. Make changes to your 2022 tax return online for up to 3 years after it has been filed and accepted by the IRS through.

#TURBOTAX 1040X EFILE 2020 FULL#

Included with TurboTax Deluxe, Premier, Self-Employed, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits. Second, get the proper form from your state and use the information from Form 1040-X to help you fill it out. Easy Online Amend: Individual taxes only. How do I clear and start over in TurboTax Online If you haven't submitted payment, deducted the TurboTax fee from your refund, or registered your product, you can still restart your return. I did not file my AZ return because of the glitch, but I need to file it. First, fill out an amended federal income tax return, Form 1040-X. How do I file an IRS extension (Form 4868) in TurboTax Online File an extension in TurboTax Online before the deadline to avoid a late filing penalty. The form also provides space for you to draft a short note to the IRS explaining why you are amending the return.

#TURBOTAX 1040X EFILE 2020 UPDATE#

The two-page form requires you to update the amounts that differ from what you reported on the first tax return. I checked again today and Turbo Tax shows the form still unavailable, but I googled it with the IRS and they say the form is available. A valid tax return amendment requires you to complete IRS Form 1040-X. We will not represent you before the IRS or. for individual, non-business returns, for the past two tax years (2021, 2020). If amending a prior year return originally filed on paper, then the amended return must also be filed on paper.

#TURBOTAX 1040X EFILE 2020 SOFTWARE#

Form 8582 Passive Activity Loss Limitations. Individual Income Tax Return electronically with tax filing software to amend tax year 2020 or later Forms 10-SR, and tax year 2021 or later Forms 1040-NR. When I filed the return, not realizing the problem, Turbo Tax told me I wouldn't be able to file an amended return until the 1040X form was available on 3/24. Individual Income Tax Transmittal for an IRS E-File Return.

Question I answered when I did my 2020 return caused a AGI.

0 kommentar(er)

0 kommentar(er)